2021 Values

Table of Contents

Jump to a section ➜

Role of the Appraisal District

Appraisal districts were created by the Texas Legislature in 1979. Each appraisal district is governed by a board of directors elected by the local taxing units. The duties and obligations of appraisal districts are set by the Texas Property Tax Code.

Under the law, the Fort Bend Central Appraisal District (FBCAD) is responsible for a number of activities in the Texas property tax system. The activity most associated with the appraisal district is the annual valuation of properties throughout the county. FBCAD is required to accurately and equitably appraise the market value of all residential, commercial, industrial, and business personal property within our district using standard, well-established, and professional mass appraisal practices. The appraisal district does not set tax rates or collect taxes. Those activities are conducted by local government offices and school districts across the county.

The Texas Property Tax Code mandates January 1st as the effective valuation date for all of our appraisals. To fulfill this requirement, the appraisal district must collect relevant information from the previous year. We collect this real-world data from multiple sources including sales transactions, construction costs (materials and labor), replacement costs, income streams and expense data, developer activity, and more. This information is then organized, categorized, and analyzed by way of ratio studies and multiple regression analysis.

The Texas Constitution requires properties to be valued at 100% of their market value. This ensures that all properties are valued fairly and uniformly. Additionally, the appraisal district is not permitted under the law to set a market value of less than 100%. The adjustments we make to values are backed by market data and statistical analysis. The appraisal district is an apolitical organization committed to valuing properties objectively and free from external influence. Our values must conform to standards set by the Texas Comptroller of Public Accounts, the Uniform Standards of Professional Appraisal Practice, the International Association of Assessing Officers, and other generally accepted appraisal methods and techniques.

Impact of COVID-19 on Appraisal Values

The COVID-19 pandemic took the entire world by surprise. That surprise gave way to uncertainty about how the events would affect 2021 real estate values.

A year ago, many experts speculated that the lockdowns and business closures would devastate the real estate market. As the end of the year approached, it became clear that the market would defy our expectations in a big way. Not only did the market not see a major downturn, but instead we saw one of the hottest markets in recent memory.

More information about the impact of COVID-19 on the real estate market can be found in the sections below.

Fort Bend County

In Texas, the first documented COVID-19 case was on March 4, 2020 in Fort Bend County.

2021 Market Overview

Our collection of national, regional, and local news stories that highlight the record-setting real estate market in 2020.

Mortgage Rates Move Sharply Higher, But Homebuyer Competition Fiercer Than Ever

REAL ESTATE / CNBC.COM

“Mortgage rates bounced higher again this week, making homebuying even more expensive at the start of the all-important spring market.”

“With home prices skyrocketing, any rise in rates knocks even more potential buyers out of the running, and yet somehow the housing market is more competitive than ever.”

The Impact of COVID-19 on the Residential Real Estate Market

REGIONAL ECONOMIST / FEDERAL RESERVE OF ST. LOUIS

“Despite the large drops in home sales due to the pandemic, real estate activity began to improve in the late spring, approaching pre-pandemic levels by the summer.”

REAL ESTATE / THE WASHINGTON POST

“Home sales set a number of records last year despite — and in some cases, because of — the coronavirus pandemic.”

“…2021 will be a robust sellers’ market as home prices hit new highs and buyer competition remains strong.”

TEXAS REAL ESTATE RESEARCH CENTER / TEXAS A&M UNIVERSITY / TAMU.EDU

“Once the pressures born of the pandemic are lifted, the multifamily market is positioned to do well because of constrained single-family supply and prices rapidly outpacing incomes…”

How Long Can It Last? Strong 2020 Housing Market Moves into Uncertain 2021

TEXAS REAL ESTATE RESEARCH CENTER / TEXAS A&M UNIVERSITY / TAMU.EDU

“Despite the onset of a pandemic, 2020 was an absolutely phenomenal year for Texas’ housing market.”

Retreat or Resurgence: Which Direction is Texas Housing Headed?

TEXAS REAL ESTATE RESEARCH CENTER / TEXAS A&M UNIVERSITY / TAMU.EDU

“Despite the toll the pandemic took on the Texas economy, the state’s housing market is faring well overall. Sales continue to rise, and new construction is up. While homeowners are confident about being able to pay their mortgages, renters, who generally have fewer financial resources, are less certain.”

Houston Real Estate Remains Insulated from February’s Artic Blast

(HAR) HOUSTON ASSOCIATION OF REALTORS / MLS PRESS RELEASE / HAR.COM

“Not even a devastating global pandemic could stop the Houston real estate market from shattering records as it crossed the finish line for the 2020 calendar year. Single-family home sales surpassed 2019’s record volume by more than 10 percent, even as the supply of homes withered to the lowest levels of all time.”

Average and median home prices have continued to climb with a noticeable spike occurring in mid-2020 in both categories.

February Monthly Market Comparison / HAR

| CATEGORIES | FEB 2020 | FEB 2021 | CHANGE |

|---|---|---|---|

| TOTAL PROPERTY SALES | 7,327 | 7,464 | 1.9% |

| TOTAL DOLLAR VOLUME | $2,085,793,177 | $2,446,513,486 | 17.3% |

| TOTAL ACTIVE LISTINGS | 38,517 | 23,933 | -37.9% |

| SINGLE-FAMILY HOME SALES | 5,979 | 6,049 | 1.2% |

| SINGLE-FAMILY AVERAGE SALES PRICE | $301,301 | $349, 963 | 16.2% |

| SINGLE-FAMILY MEDIAN SALES PRICE | $245,000 | $275,900 | 12.6% |

| SINGLE-FAMILY MONTHS INVENTORY* | 3.3 | 1.6 | -1.7 mos. |

| SINGLE-FAMILY PENDING SALES | 7,428 | 8,288 | 11.6% |

*Months inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity. This figure is representative of the single-family homes market.

Total dollar volume is up more than 17% while inventory dropped to record lows.

The average and median sales prices of homes have increased by double digits.

The changes shown here reveal the strongest market in recent years.

HOUSTON AGENT MAGAZINE / HOUSTONMAGAZINE.COM

“The housing market showed little sign of slowing in November, with sales up 20% over last year for RE/MAX brokers, according to the company’s National Housing Report.”

“While there was a seasonal decline, the sales volume is a new record high in the 13-year history of the report. Sales were down 14.5% from the previous month, which closely follows the average decline of 12% over the past five years.”

“Inventory also reached its lowest point in the report’s history, down 31.8% from the same time last year and down 13.3% from October.”

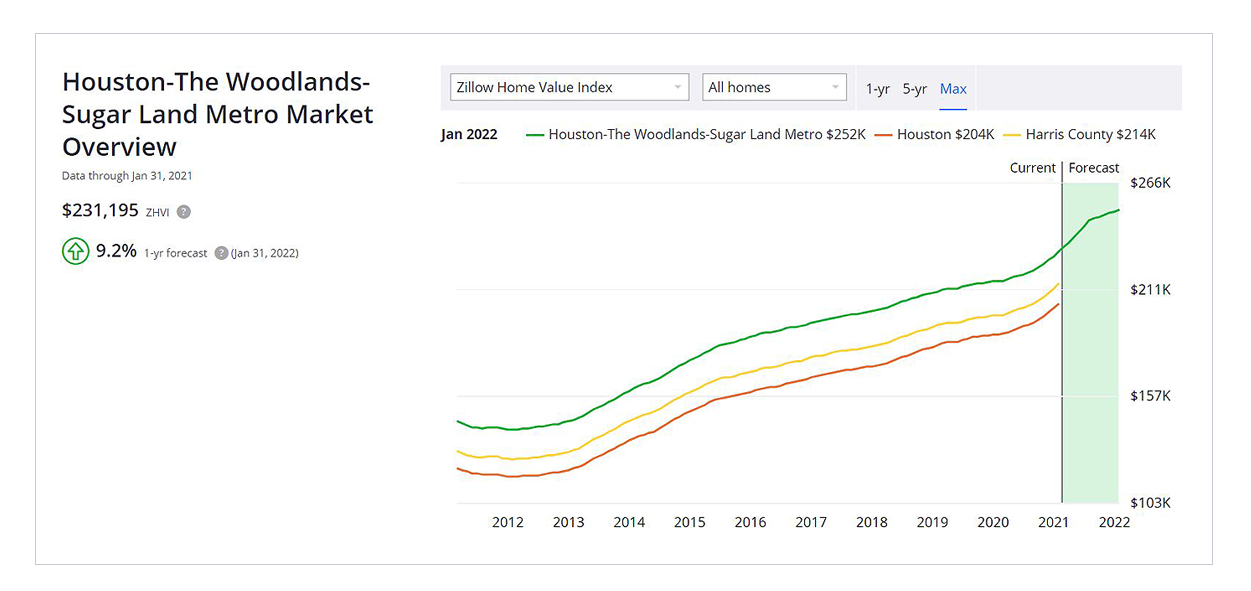

Houston Housing Market: Prices | Trends | Forecast 2021

NORADA REAL ESTATE INVESTMENTS / NORADAREALESTATE.COM

“Houston-The Woodlands-Sugar Land Metro home values have gone up 7% over the past year and the latest forecast is that they will rise 9.2% in the next twelve months.”

Residential Property

The COVID-19 pandemic injected a tremendous amount of uncertainty into the residential real estate market in 2020.

FBCAD heard from many property owners who were concerned that the pandemic and associated shut down would negatively affect the value of their homes and businesses. Many expected that we would see the residential market bottom out as buyers hunkered down amid the uncertainty.

As a new normal took shape, it seemed the pandemic and response would create turmoil for home values and finally end the years long growth in the sector.

Following the initial March lockdown, residential property sales did see a temporary dip in activity heading into the third quarter. A temporary setback in the second quarter was followed by unprecedented activity in the last two quarters. Defying all expectations, home buyers instead saw an opportunity.

Several key factors lined up to produce a boom that catapulted the market to new highs:

- Near-record low interest rates incentivized homebuying and refinancing. Many buyers were able to utilize low rates to maximize their purchasing power in the market.

- Economic stimulus funds from the federal government provided liquidity which assisted buyers with closing costs.

- Many buyers were motivated by a need for better work-from-home amenities.

- The entire State of Texas saw an incredible amount of relocation activity. Many buyers were coming from out of state or from more dense, urban areas.

- A record low supply of homes resulted in remarkably fewer days on market. The scarcity of available homes created a seller’s market for those who had their home listed on the market.

- Builder costs increased dramatically pushing new home values higher. Some of the increased costs were caused by materials shortages due to manufacturing and shipping interruptions from the pandemic.

- Builders pushed to increase the supply of new homes on the market but struggled to keep up with demand due to increased costs and materials shortages.

[wpfa5s icon=”hammer” size=”2x” color”#d64f2a”]

The 2021 tax year saw a 21.35% increase in new construction with a drastic increase in Lamar CISD.

[wpfa5s icon=”compass” size=”2x” color”#d64f2a”]

New construction, predictably, was concentrated in the north and east, but growth is apparent throughout the county.

[wpfa5s icon=”home” size=”2x” color”#d64f2a”]

FBCAD added more than 9,000 new residential properties for 2021, a record high.

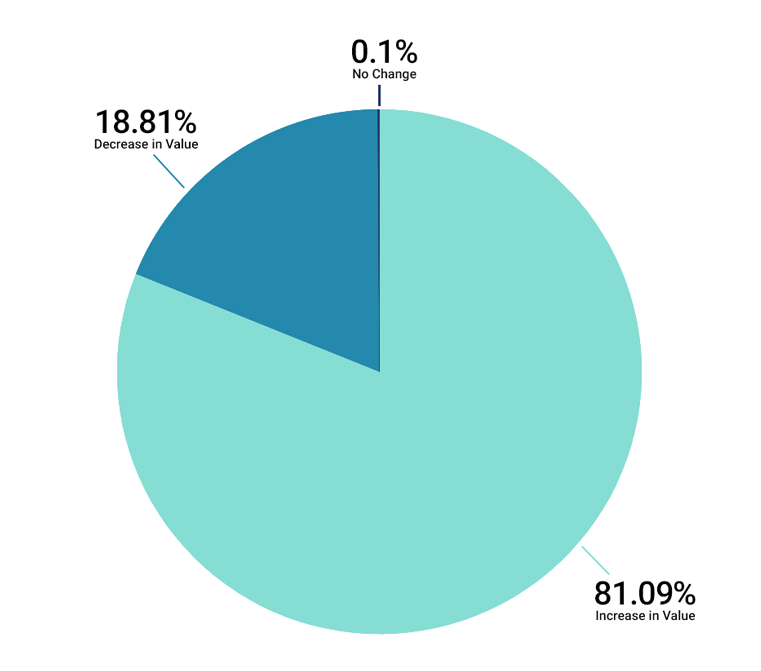

Overall, the average change in value for a residential property is an increase of 6.47%.

Fort Bend County Average Residential Market Values

| 2020 | 2021 | % DIFF | |

|---|---|---|---|

| Real Residential | $284,872 | $303,317 | 6.47% |

| W/ Homestead | $313,170 | $327,591 | 4.60% |

Commercial Property

Key Factors

Several key factors that contributed to the growth in commercial values:

- Pandemic related supply and demand issues led to shortages in building materials resulting in drastic increases in the cost of construction. Some of these shutdowns were compounded by manufacturing shutdowns, the closure of ports across the world, and nationwide weather events.

- Competition among builders for vacant land did not slow down. For the past several years, Fort Bend County has seen tremendous growth. This trend continued despite the pandemic due to interest in Fort Bend County’s relatively inexpensive and plentiful open land.

- Federal stimulus dollars allowed many companies to continue operating when they may not have otherwise been able to. The Paycheck Protection Program provided relief to struggling businesses.

- Many businesses pivoted to offer online or curb-side services ensuring continued operations as they adjusted to the pandemic.

As with residential property, the commercial property outlook at the onset of the COVID-19 pandemic was anything but rosy. The end of the second quarter saw lower rents, higher vacancies, and a drop in net absorption as businesses struggled to respond to new mandates.

The third and fourth quarters; however, saw the trends reversing. Office vacancies increased but medical office and industrial saw drastic improvement while retail vacancies were surprising flat. Rents were up across all of these properties. Many businesses did surprisingly well and even thrived in 2020, deftly adjusting to the changing landscape.

As a new normal was established for our community, the commercial real estate market demonstrated a remarkable resilience. For example, some property types, like warehouses, increased in value due to strong sales, shifting business models, and continuing trends in e-commerce.

Many big-box businesses (large format retailers, grocery stores, and home improvement stores) realized record sales volume resulting from their status as essential businesses.

Some commercial property types, like fitness centers, daycares, and some restaurants, were adversely affected by the pandemic.

These property types will receive a negative economic adjustment to address the impact the lockdowns had on these types of businesses.

[wpfa5s icon=”building” size=”lg” color”#d64f2a”] The overall value for commercial property increased 9.39% from 2020 to 2021.

[wpfa5s icon=”hammer” size=”lg” color”#d64f2a”] Increased construction costs and commercial new construction accounted for most of the increase.

Reducing Your Property Tax Burden

Homestead

The homestead exemption remains the easiest way to reduce your property taxes by as much as 20%.

We want every property owner to be fully informed as to the various ways they can reduce their property tax burden. The homestead exemption remains the easiest way to reduce your property taxes by as much as 20%. Beyond that, you may be eligible for the over 65, disability, veterans, or disaster exemptions, among others.

In the last year, FBCAD launched a new online exemptions portal that allows for remote submission of applications and emailed status updates. The portal can be accessed by visiting https://www.fbcad.org/exemption-application/. Also, a full list of exemptions can be found at www.fbcad.org/fbcad-forms/ under “Homestead Exemptions” and “Miscellaneous Exemptions”.

If you want to check to see what exemptions are associated with your property, please search for your account on our website at https://esearch.fbcad.org/. Please note that certain information may not be displayed in order to protect your privacy. Our Information and Assistance team is on standby to address any exemption questions you may have.

The protest process provides another avenue for reducing your property’s value which may reduce your overall tax burden. While we try to set an accurate and fair value for all properties, you may have additional information specific to your property or market area. For this reason, the state legislature created the protest process to officially appeal the value set by the appraisal district. In the past year, we have made significant changes to make the online appeals process more transparent and user-friendly. For more information, please visit the “Appeals” section of this website at www.fbcad.org/appeals/.

Appealing your value can be a nerve-racking experience. Recognizing this, the Texas Comptroller has produced a set of videos that provide an overview of the protest process for individual homeowners and small businesses. The videos also cover the most common situations that arise in a protest hearing. We host these videos here at www.fbcad.org/property-tax-videos/.

[wpfa5s icon=”building” size=”lg” color”#d64f2a”] The overall value for commercial property increased 9.39% from 2020 to 2021.

Property Tax Transparency Website

Transparency

www.fortbendtax.org provides clarity with truth-in-taxation.

Appraisal values are just one part of the property tax equation. The other main factor impacting your property tax amount is the rate set by the local taxing entities in the fall of each year. Property owners are invited every year to get involved in this process. In order to provide the community with additional information on the tax rate adoption process, FBCAD created a property tax transparency website. The goal of this truth-in-taxation website is to increase transparency in the property tax system while educating the public on the tax rate adoption process.

Visit www.fortbendtax.org for more.