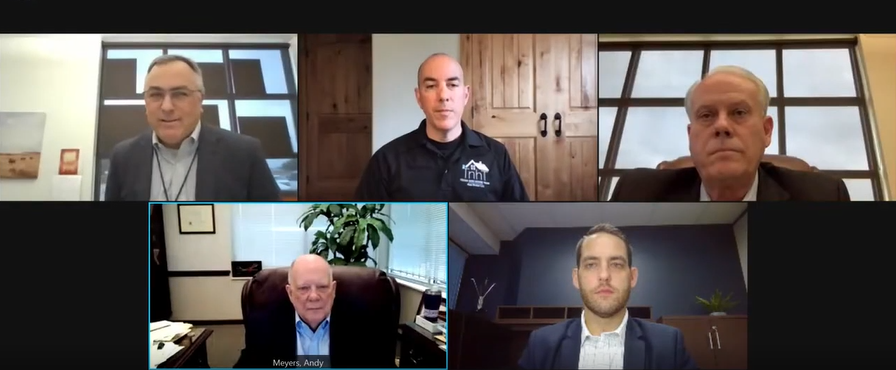

2021 Property Tax System Workshop

Chief Appraiser Jordan Wise joins Precinct 1 Commissioner Vincent Morales, Precinct 3 Commissioner Andy Meyers, and City of Fairchild Mayor Lance Bertolino in a conversation about the role of the appraisal district in the property tax system.

Video

ARB Hearing Guide for Homeowners

DESCRIPTION:

This video provides an overview of the appeal process and covers the most common situations that arise in a protest hearing. It allows .50 CE in the appraisal standards and methodology category.

Video

ARB Hearing Guide for Small Business

DESCRIPTION:

This video provides an overview of the appeal process and covers the most common situations that arise in a protest hearing. It allows .50 CE in the appraisal standards and methodology category.

Video

Protests & Appeals In The Tax Code

DESCRIPTION:

This video highlights certain Tax Code sections that are applicable to filing a protest with the local appraisal review board and to appealing an appraisal review board determination. It allows .25 CE in the laws and rules category.

More To Watch

This video provides an overview of the 2020-2021 MAP review process and the questions, documents and processes reviewed during this cycle. It allows .50 CE in the laws and rules category.

How To Protest Property Value Study Results

This video offers guidance on considering and preparing a protest of the preliminary findings of taxable value in the Comptroller’s property value study (PVS). It allows .50 CE in the appraisal standards and methodology category

This video provides an overview of revisions made to the classification guide. It allows .75 CE in the appraisal standards and methodology category.

This video provides an overview of the legal requirements for appraising open-space land. It allows .50 CE in the appraisal standards and methodology category.

Reappraisal Plan and Planning Basics

This video explains the requirements of Tax Code Section 25.18 and provides information to help appraisal districts prepare a reappraisal plan. It allows .50 CE in the appraisal standards and methodology category.

This video offers a general overview of the residence homestead exemption and form. It allows .25 CE in the appraisal standards and methodology category.

This video provides general information regarding property tax exemptions, qualifications and applicable law. It allows 1 CE in the appraisal standards and methodology category.

The Basics of the Property Value Study and How to Read Your Results

This video provides an overview of the property value study including how to read the results. It allows 1.50 CE in the appraisal standards and methodology category.

Where to Find it in the Tax Code: Property Tax Appraisal

This video highlights certain Tax Code sections that are applicable to the appraisal of property in Texas. It allows .50 CE in the laws and rules category.

Wildlife Management Use and Reporting Requirements

This video reviews the wildlife management use appraisal requirements and reporting requirements. It allows .50 CE in the appraisal standards and methodology category.

More information can be found at the Texas Comptrollers Official Website