2022 Values

Market Trends Report

In the interest of openness and transparency, FBCAD is publishing this market trends report summarizing the role of the appraisal district in the property tax system, the real estate market activity affecting your 2022 value, ways property owners can limit their tax liability, as well as resources available to property owners as they navigate the tax rate adoption process.

This report is by no means exhaustive; however, we do hope it conveys useful information to the citizens of Fort Bend County.

If you have any questions, comments, or concerns, please reach out to info@fbcad.org or give us a call at 281-344-8623.

Table of Contents

Role Of The Appraisal District

Appraisal districts were created by the Texas Legislature in 1979. Each appraisal district is governed by a board of directors elected by the local taxing units. The duties and obligations of appraisal districts are set by the Texas Property Tax Code.

Under the law, the Fort Bend Central Appraisal District (FBCAD) is responsible for a number of activities in the Texas property tax system. The activity most associated with the appraisal district is the annual valuation of properties throughout the county.

FBCAD is required to accurately and equitably appraise the market value of all residential, commercial, industrial, and business personal property within our district using standard, well-established, and professional mass appraisal practices.

The appraisal district does not set tax rates or collect taxes. Those activities are conducted by local government offices and school districts across the county.

The Texas Property Tax Code mandates January 1st as the effective valuation date for all of our appraisals. To fulfill this requirement, the appraisal district must collect relevant information from the previous year.

We collect this real-world data from multiple sources including sales transactions, construction costs (materials and labor), replacement costs, income streams and expense data, developer activity, and more. This information is then organized, categorized, and analyzed by way of ratio studies and multiple regression analysis.

The Texas Constitution requires properties to be valued at 100% of their market value. This ensures that all properties are valued fairly and uniformly. Additionally, the appraisal district is not permitted under the law to set a market value of less than 100%. The adjustments we make to values are backed by market data and statistical analysis.

The appraisal district is an apolitical organization committed to valuing properties objectively and free from external influence. Our values must conform to standards set by the Texas Comptroller of Public Accounts, the Uniform Standards of Professional Appraisal Practice, the International Association of Assessing Officers, and other generally accepted appraisal methods and techniques.

2022 Market Overview

Our collection of national, regional, and local news stories that highlight the record-setting real estate market in 2021.

REAL ESTATE / HAR.COM

“The second year of a global pandemic, dwindling inventory, building supply and labor shortages that slowed home construction, and rising home prices could not prevent the Houston real estate market from turning 2021 into a record year.”

Source: HAR.com

Average and median home prices have continued to climb with a noticeable spike occurring in late-2021 in both categories.

Source: HAR.com

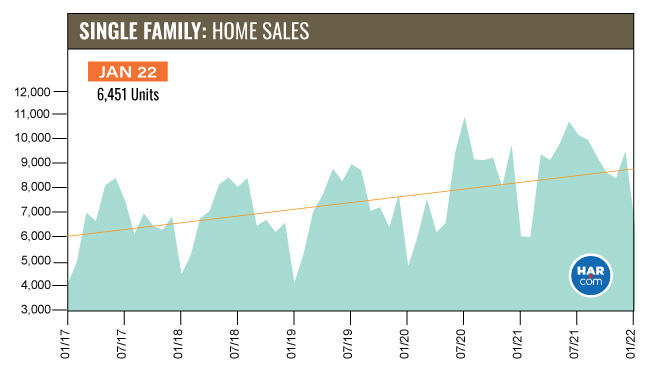

Total home sales also continue to trend upward.

Source: HAR.com

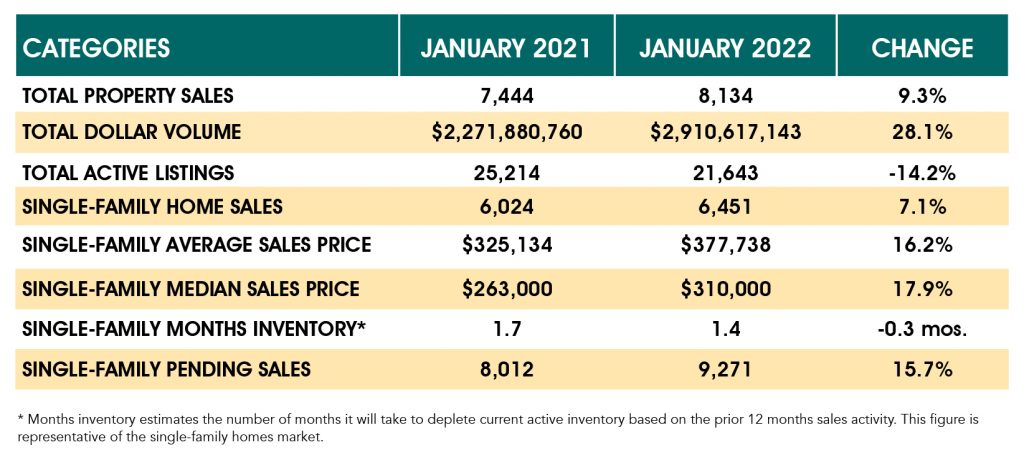

Total dollar volume is up more than 28% while inventory dropped to record lows. The average and median sales prices of homes have increased by double digits. The changes shown here reveal the strongest market in recent years, beating out 2020’s record setting year.

Editor’s Note: It’s important to note that the numbers HAR provides differs from how FBCAD develops its numbers. HAR is looking at only sales activity while FBCAD considers every property in the county.

Soaring Home Prices Are Roiling Appraisals and Upending Sales (10/2021)

REAL ESTATE / WALL STREET JOURNAL

“More properties are being valued below their agreed-upon sales prices, causing deals to collapse”

REAL ESTATE / AXIOS

“Housing is probably going to keep getting more and more expensive, despite the Fed’s efforts to cool the market.”

REAL ESTATE / WASHINGTON POST

“…Investors bought nearly one in seven homes sold in America’s top metropolitan areas, the most in at least two decades…”

“…Investors were even more aggressive in the final three months of the year, buying 15 percent of all homes that sold in the 40 markets…”

NATIONAL / WASHINGTON TIMES

“Rents have exploded across the country, causing many to dig deep into their savings…”

TEXAS REAL ESTATE RESEARCH CENTER / TEXAS A&M UNIVERSITY / TAMU.EDU

“A combination of housing indicators is signaling the housing frenzy could be over. Both sales growth and price growth have peaked and are slowing. In addition, months of inventory, listings, and days on market have reached a trough and are rising…

…Demand is expected to remain relatively strong with improving inventories accompanied by moderate housing price growth in an environment of slowly rising mortgage rates…”

TEXAS REAL ESTATE RESEARCH CENTER / TEXAS A&M UNIVERSITY / TAMU.EDU

“The fourth quarter saw a continued uptick in both the median sales price and first-quartile sales price for Texas (Figure 1).1 The year-over-year (YOY) growth in median sales price and first-quartile home price in Texas measured 17.6 percent and 15.4 percent, respectively, significantly higher than average YOY growth for the fourth quarter…

…Without comparable growth in incomes, the rapid rise in home prices will continue to squeeze purchase affordability, or the ability of a household to buy a home…”

Report: The Texas pandemic housing frenzy is over and prices are cooling – WFAA (11/2021)

RIGHT ON THE MONEY / ABC8

“D-FW, Houston, and Austin have seen home prices drop off a bit in recent months. But prices are expected to keep climbing in the years ahead…

It’s been one wild house party in Texas — that might be over now. But predictions are that Texas will still have an after-party. It’ll just be a whole lot more chill.”

Year of frenzy: Houston’s housing market soared to new heights in 2021. Will 2022 be the same? (01/2022)

REAL ESTATE / HOUSTON CHRONICLE

“Sales of all homes, including condos and townhomes, jumped 13 percent in 2021 to more than 130,000 — only the third time in history that sales surpassed the 100,000-units threshold…

…Prices for single-family homes climbed more than 15 percent to a record annual median of $300,000…

…While 2022 may not see the same scorching hot growth, real estate experts expect this year to be another strong, competitive year for homebuyers battling escalating prices, tight supply and rising interest rates.”

Residential Property

The uncertainty that followed the start of the COVID-19 pandemic in 2020 all but disappeared in the real estate market in 2021. The trends that contributed to a record 2020 continued in 2021 and accelerated to create the most active market in Fort Bend history.

There were several key trends that pushed the market to new highs:

- Near-record low interest rates incentivized homebuying and refinancing. Many buyers were able to utilize low rates to maximize their purchasing power in the market. This trend seems to be reversing now as the Fed announced interest rate hikes.

- Economic stimulus funds from the federal government provided liquidity which assisted buyers with closing costs. Although stimulus seemed to help many Americans during these challenging times, the unprecedented money printing contributed to rising inflation.

- Buyers continue to be motivated by a need for better work-from-home amenities.

- The entire State of Texas saw an incredible amount of relocation activity. Many buyers were coming from out of state or from more dense, urban areas. “1k per day” continued.

- A record low supply of homes, almost non-existent below $200k, resulted in remarkably fewer days on market. The scarcity of available homes created a seller’s market for those who had their home listed on the market.

- Builder costs increased dramatically in 2020 and this trend only accelerated in 2021. Some of the increased costs were caused by materials shortages due to manufacturing and shipping interruptions, labor shortages, inflation, and other factors.

- Builders pushed to increase the supply of new homes on the market but struggled to keep up with demand due to increased costs and materials shortages.

- Investors made record purchases, nearly 1 in 7 homes nationally. This increase in demand on an already limited supply helped to push home values even higher.

- Fort Bend had already established itself as a fast-developing county. The increased market activity has only accelerated this trend.

The 2022 tax year saw a 21% increase in new construction in Fort Bend County.

This marked the first time in FBCAD history that we’ve added more than 10,000 homes to the appraisal roll in a single year. New construction, predictably, was concentrated in the north and east, but growth is apparent throughout the county.

It’s important to note that FBCAD utilizes generally accepted appraisal practices when developing values. All valid market transactions (“comparables” or “comps”) are considered when building the appraisal model for a given neighborhood. The goal of our models is to achieve a median sales ratio and valuation ratio of 100%. For reference, the sales ratio is determined by dividing the appraised value by the sale price.

For tax year 2022, the average change in value for a residential property is an increase of 31%.

Properties with a homestead exemption will see an average increase in market value of 28%.

The homestead exemption remains the best way to save up to 20% on your property taxes. Review the “Reducing Your Property Tax Burden” section below for more details.

Commercial Property

Growth in the commercial property space has been similarly strong.

Many businesses have shifted away from shared office space to allow for more work-from-home and hybrid arrangements; however, traditional office space and medical office space still showed strong growth. Expectations were that these spaces might see some stagnation, but values are up over 30%.

Moderate increases were seen in retail with an average increase of 7%. Existing trends related to ecommerce continue to affect retail value; however, this space benefitted from the reopening of the economy and a public fatigued from quarantine.

Large growth in values can be seen in the warehouse and apartment segments. Warehouses are up an average of 33% while apartments are up an average of 18%.

The overall value for commercial property increased 16% from 2021 to 2022.

Increased construction costs, commercial new construction, and rising land values accounted for much of the increase. Appraisers also created new income models for several property types including apartments, warehouses, retail, hotels, and others. These models shift the valuation of these properties from a cost approach to an income approach, which is more consistent with generally accepted appraisal practices.

Several key factors that contributed to the growth in commercial values:

- Pandemic related supply and demand issues led to shortages in building materials resulting in drastic increases in the cost of construction. Some of these shutdowns were compounded by manufacturing shutdowns, the closure of ports across the world, and labor shortages.

- Competition among builders for vacant land did not slow down. For the past several years, Fort Bend County has seen tremendous growth. This trend continued despite the pandemic due to interest in Fort Bend County’s relatively inexpensive and plentiful open land. The increased demand we saw in 2021 pushed values even higher.

- In Texas, many businesses experienced a better-than-expected rebound from the prior year’s mandated closures, particularly evident with retail property. Although many observers worried that the governor’s decision to reopen the Texas economy would have disastrous affects for public health, the decision proved fruitful for businesses throughout the state.

- As with residential property, Fort Bend had already established itself as a fast-developing county. The increased market activity has only accelerated this trend.

- Many buyers had difficulty in the residential market which may contribute to higher demand in multi-family rentals.

Land Development

Land development in Fort Bend County continues to show strength. In some jurisdictions, like Sugar Land, developers are finding less and less viable space amidst increasing competition.

This is impacting land values significantly and pushing more development to the south and west.

Additionally, large agricultural tracts in Fort Bend are routinely developed into subdivisions. These new, smaller lots tend to sell at a much higher price per square foot after infrastructure is developed and improvements are built. Notably, the largest master planned community in the last 20 years is expected to break ground in Q2 of 2022, adding 14,000 new homes and opportunity for much more commercial development in the area. These trends are expected to continue.

Land along the major highways, I-69 and I-10, saw the most dramatic increases this year.

On average, across all types of properties, land values are up 25% throughout the county.

Reducing Your Property Tax Burden

Homestead

The homestead exemption remains the easiest way to reduce your property taxes by as much as 20%.

We want every property owner to be fully informed as to the various ways they can reduce their property tax burden. The homestead exemption remains the easiest way to reduce your property taxes by as much as 20%.

Beyond that, you may be eligible for the over 65, disability, or veterans among others.

In 2020, FBCAD launched a new online exemptions portal that allows for remote submission of exemptions applications and emailed status updates. The portal can be accessed by visiting https://www.fbcad.org/exemption-application/. Also, a full list of exemptions can be found at www.fbcad.org/fbcad-forms/ under “Homestead Exemptions” and “Miscellaneous Exemptions”.

If you want to check to see what exemptions are associated with your property, please search for your account on our website at https://esearch.fbcad.org/. Please note that Texas law prohibits the appraisal district from displaying certain information in order to protect your privacy. Our Information and Assistance team is on standby to address any exemption questions you may have. Reach them by phone at 281-344-8623 or send an email to info@fbcad.org.

Appeals

We have made significant changes to make the online appeals process more transparent and user-friendly.

The value appeal process provides another avenue for reducing your property’s value, which may reduce your overall tax burden. You know your property best and may have additional information specific to your property or market area that supports a change in value. For this reason, the state legislature created the protest process to officially appeal the value set by the appraisal district. We have made significant changes to make the online appeals process more transparent and user-friendly. For more information, please visit the “Appeals” section of this website at www.fbcad.org/appeals/.

Appealing your value can be a nerve-racking experience. Recognizing this, the Texas Comptroller has produced a set of videos that provide an overview of the protest process for individual homeowners and small businesses. The videos also cover the most common situations that arise in a protest hearing. We host these videos here at www.fbcad.org/property-tax-videos/.

Impact Of COVID-19 On Appraisal Values

Fort Bend County

In Texas, the first documented COVID-19 case was on March 4, 2020 in Fort Bend County.

COVID-19 continued to be a global issue through 2021; however, the initial uncertainty following the lockdowns and restrictions quickly gave way to a radically shifting real estate market.

Observers were stunned to find homes selling well above their asking price and with multiple bidders. Inventories were obliterated as demand peaked. Mandatory closures had a major impact on manufacturing and supply chains.

Homebuilders saw their costs rise dramatically as essential materials were delayed. Additionally, the pandemic led many to reconsider their existing living situation and seek additional space, particularly in areas with less density.

Earlier in this report, we expanded on what we felt were the main drivers for this unprecedented activity. While many observers initially expected the pandemic to negatively affect values, the data showed radically increasing activity and values.

Homestead Cap

Although the market value set by the appraisal district reflects what similar properties are selling for, many property owners with a homestead exemption will find that their appraised value is capped at a 10% increase. This is meant to protect homeowners from rapidly increasing values such as we’re seeing this tax year.

For example, if your home was valued at $100,000 in 2021 and the market value increased to, say, $120,000, the homestead cap would limit the increase to $110,000. If you multiply your final 2021 value by 1.1, you’ll find the maximum value that your property can be taxed at with your homestead exemption in 2022.

Recent Legislation Limits Tax Increases

In 2019, the Texas legislature capped the revenue counties and cities can collect. Most taxing entities are limited to a 3.5% increase without needing voter approval. School districts, which typically represent the largest portion of your overall tax bill, are capped at 2.5%. This means that the taxing entities will be required to lower tax rates unless they want to seek voter approval for more. So, your value may have increased, even substantially, but the taxing entities are limited in their ability to raise taxes.

Proposed Constitutional Amendments

Property owners should also be aware of two proposed constitutional amendments that are up for a vote on May 7th of this year.

The first would increase the homestead exemption by $15,000, thereby reducing the individual homeowners tax burden for 2022 (This change would only apply to your school district taxes).

If approved, FBCAD will automatically apply the increased exemption amounts to eligible properties.

The second proposed amendment would further limit value increases for elderly and disabled homeowners. If passed, the author of the law states, “This amendment would reduce the approximate 2 million exemption holders’ school tax bill, on average, $110 the first year and by $124 the second year.”

Follow the link here for more information:

https://www.sos.state.tx.us/about/newsreleases/2022/012622.shtml

Property Tax Transparency Website

Transparency

www.fortbendtax.org provides the public with data for clarity with truth-in-taxation.

Appraisal values are just one part of the property tax equation. The other main factor impacting your property tax amount is the rate set by the local taxing entities in the fall of each year. Property owners are invited every year to get involved in this process. In order to provide the community with additional information on the tax rate adoption process, FBCAD created a property tax transparency website. The goal of this truth-in-taxation website is to increase transparency in the property tax system while educating the public on the tax rate adoption process. Visit www.fortbendtax.org for more.