Completing Your BPP (Business Personal Property) Rendition

A Step-By-Step Guide for Form 50-144

Texas Property Code

The Texas Property Code requires all personal property owned by a business for the purpose of producing an income to be reported, or rendered, to the appraisal district for valuation.

This guide will walk you through the process of completing your BPP rendition form.

Ways to File

Things to Remember

- The rendition is concerning personal property owned by the business on January 1st of the tax year. Not December 31st. Not January 2nd.

- Only tangible personal property such as furniture, fixtures, equipment, inventory, etc. are taxable. Intangibles such as cash, stocks, accounts receivable, and other paper assets are not taxable.

- The BPP rendition form is due by April 15th each year. Deadline extensions are available with a written request of up to 30 days.

- Many property owners will receive a rendition form with some details already filled in.

- All fields are required unless otherwise indicated as ‘optional’.

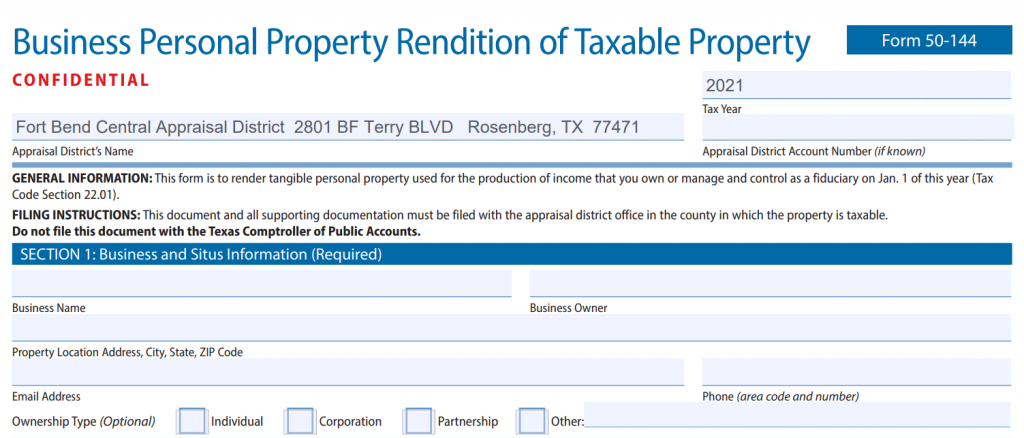

- At the very top, you will indicate the tax year for which the rendition applies.

- The Appraisal District’s name will be Fort Bend Central Appraisal District if your business personal property is physically located in Fort Bend County.

- The Appraisal District Account Number can be the Quick Reference ID (RXXXXXX) or the 16-digit Property ID; if this is your first rendition and an account has not yet been created.

Section 1: Business & Situs Information

- Business name should be consistent with your Secretary of State filings.

- Business owner should also be consistent with your Secretary of State filings.

- Property location is the actual, physical location of the business personal property; also called situs.

- Contact email and phone number should be provided for easy communications.

- Ownership type is optional but helpful.

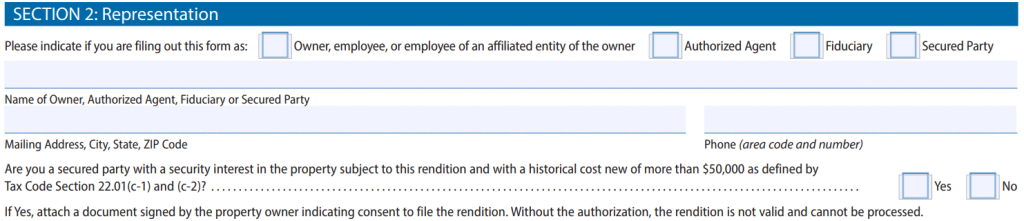

Section 2: Representation

- Is this form being completed by the owner? Authorized agent? Fiduciary? Secured Party? Please indicate.

- If owner, repeat name and phone number.

- Provide the mailing address you would like communications to be sent; this does not have to be the same as the property location.

- Indicate whether you are a secured party with a security interest in the property. If you are not sure what this is, please consult your legal counsel. Documentation is required if selecting “Yes”.

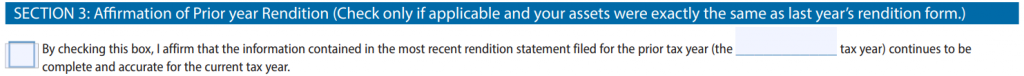

Section 3: Affirmation of Prior Year Rendition

- Was your prior year rendition the same as this year?

- Your assets must be exactly the same as the previous year.

- Check the box and type in the previous year.

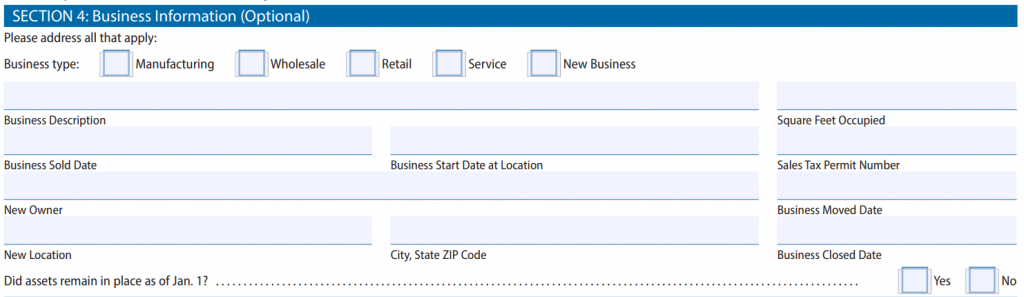

Section 4: Business Information (optional)

- Section 4 is optional, but the information provided is helpful for our appraisers.

- What is your business type? Manufacturing? Wholesale? Retail? Service? New business?

- Business description will help us to properly classify your property.

- If you sold of moved your business, you will indicate so in the appropriate field. Failure to do so may result in erroneous tax statements and lengthy correction processes.

- Did assets remain in place as of Jan 1st? Or were they moved elsewhere?

Section 5: Market Value

- What is the approximate value of your personal property? Under $20,00? Or over $20,000?

- The requirements for filing with property under $20,000 are different than for businesses valued over $20,000.

- Under? Complete Schedules A and F if applicable.

- Over? Complete schedules B, C, D, E, and/or F, as applicable.

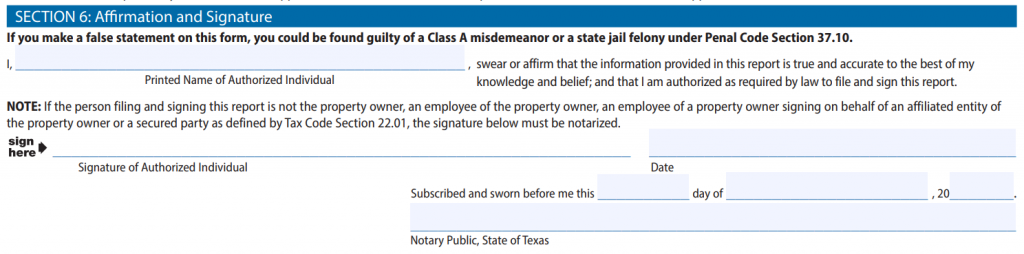

Section 6: Affirmation and Signature

- Note: If the person filing and signing this report is not the property owner, an employee of the property owner, an employee of a property owner signing on behalf of an affiliated entity of the property owner, or a secured party as defined by Tax Code Section 22.01, the signature must be notarized.

- Printed Name of Authorized Individual – The person who either owns the property, is the agent, or holds fiduciary responsibility for the business.

- Signature of Authorized Individual should be the same person as the Printed Name of the Authorized Individual.

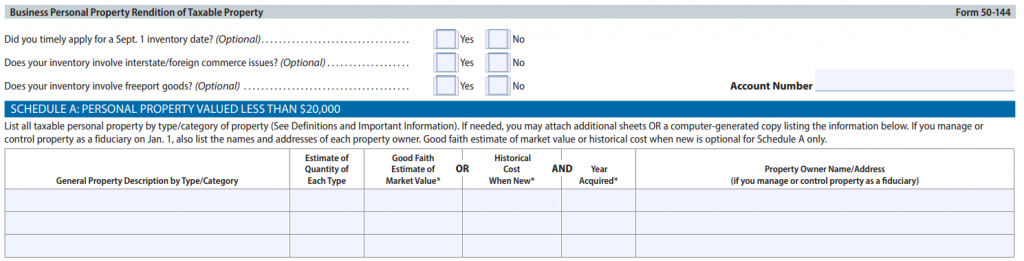

Schedule A: Personal Property Valued Less Than $20,000

- The “optional” questions are useful to our staff and should be answered if applicable.

- This section is applicable to businesses with less than $20,000 in personal property.

- Under Schedule A, general property descriptions by type/category are listed. Categories may include furniture, fixtures, inventory, machinery, office equipment, computer equipment, raw materials, supplies, and vehicles.

- Estimate of quantity of each type.

- Then, list a good faith estimate of market value OR historical cost when new.

- Enter the year the property was acquired. This helps to properly depreciate the items.

- Fiduciaries will need to list the property owner’s name and address in the last column.

- If needed, it is permissible to attach additional sheets if you need more space to list your items.

Schedule B and C: Inventory, Raw Materials and Work in Progress / Supplies

- Schedule B and C are required if the total value of all property exceeds $20,000 and own the type of property described in the heading.

- Similar to Schedule A, Schedule B and C requires a list of the property type/category, and estimate of quantity for each type, and a good faith estimate of current market value.

- Schedule B should list only inventory, raw materials, and work in progress.

- Schedule C should list only supplies.

- In lieu of good faith estimates of value, you may instead list historical cost new AND the year the property was acquired.

- The taxable location, the property address, must also be listed for each type.

- Fiduciaries will need to list the property owner name and address in the last column.

- If additional space is required, it is permissible to attach supplement pages with the required information.

Schedule D: Vehicles and Trailers and Special Equipment

- Schedule D is required if the total value of all property exceeds $20,000 and you have property that fits the description under schedule D.

- The year, make, model, and vehicle identification number of each vehicle is optional, but useful to determine an accurate value.

- A good faith estimate of the vehicles is required.

- In lieu of the good faith estimate, you may provide the historical cost when new AND the year acquired.

- If additional space is required, it is permissible to attach supplement pages with the required information.

Schedule E: Furniture, Fixtures, Machinery, Equipment, Computers

- This section breaks down the type of property by year acquired.

- In each section, you will provide the historical cost when new OR good faith estimates of market value.

- Items received as a gift should also be listed with a good faith estimate of market value.

- There is also an “Other” section for any items owned by the business that were not listed in any other section. Reminder: intangible personal property is not taxable and does not qualify as “other”.

- If additional space is needed, it is permissible to add additional sheets or a computer printout of the items.

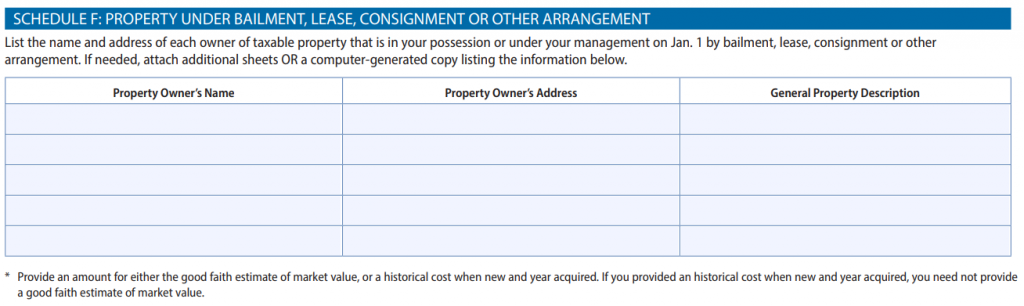

Schedule F: Property Under Bailment, Lease, Consignment or Other Arrangement

- This section should be completed by any business that possesses this type of property regardless of total market value of all property.

- List the property owner’s name, address, and a general description of the property.

- A good faith estimate OR historical cost when new AND year acquired should be listed in the description.

- If additional space is needed, additional sheets may be attached.

- The last page of the rendition contains important information about deadlines, filing instructions, penalties, as well as definitions of common terms that will help users more fully understand the requirements.