Consumer Alert: Homestead Designation Services

FBCAD wants to emphasize that there is no fee associated with filing a Residential Homestead Exemption through our office. The forms required for this purpose are readily available at no cost and you may also file for free through FBCAD’s eFile feature — File Now

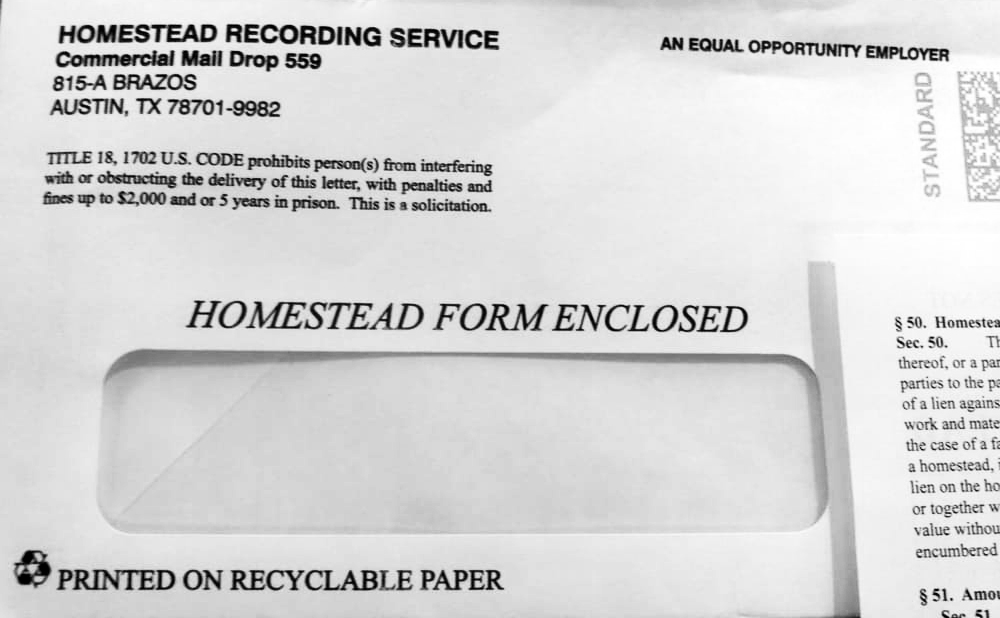

Please note that if you have received a letter via mail, it is important to clarify that it did not originate from the FBCAD (Fort Bend Central Appraisal District).

Prior to responding to this correspondence, we strongly advise consulting with either a legal representative or the appraisal district directly.

Kindly review the details located at the bottom of the letter attentively.

It’s crucial to note that HOMESTEAD RECORDING SERVICE is not affiliated with any governmental body or tax authority.

Please take careful note of the fine print provided at the bottom of the document sent by this service:

This document is an advertisement of service. It is not an official document of the State of Texas. The designation of homestead under the TEXAS PROPERTY CODE is distinct from the homestead tax exemption under the TEXAS TAX CODE. If a homeowner files for and receive a TAX EXEMPTION, they will receive a Designation of Homestead eventually for free. For information regarding the homestead tax exemption contact your tax appraisal district. For information regarding homestead designation under the TEXAS PROPERTY CODE, contact your attorney.

Homestead property is protected under Texas law. Recording a “Designation of Homestead” in the public records is optional. To file a designation of homestead, you are not required to use this form or this service. Prices subject to change without notice.

YOU MUST REMIT THE $35.00 FEE OR WE WILL NOT PREPARE YOUR DOCUMENT.