Estimated Taxes

Due to recent legislative changes, the 2022 appraisal notice does not include an estimate of taxes. However, information on tax rates can be found online at www.fortbendtax.org.

In previous years, FBCAD provided an estimate using the current year’s taxable value and the prior year’s tax rate. Legislative changes have limited the ways local government can raise tax rates without voter approval. Using last year’s rate could drastically overestimate the tax levy for 2022.

The tax rate adoption process will begin after the chief appraiser certifies the appraisal roll in late July. Property owners can follow this process by visiting www.fortbendtax.org.

Unfortunately, we are unable to provide an estimate of the amount of taxes owed. We apologize for any inconvenience this may cause.

One way you could estimate your taxes is to use the 2022 taxable value, found on the 2022 appraisal notice, multiplied by the 2021 adopted tax rate, found on www.fortbendtax.org divided by 100. As stated previously, using this method may overestimate your taxes since new laws limit revenue increases for taxing entities.

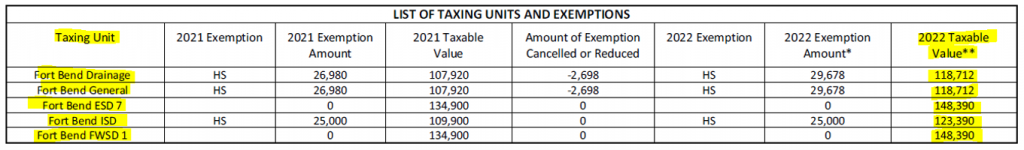

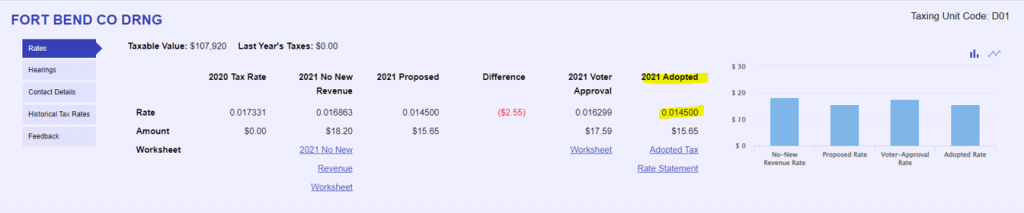

An example below: Fort Bend Drainage has a 2022 Taxable Value of $118,712. Fort Bend County Drainage reports their 2021 adopted tax rate as 0.014500.

$118,712 x 0.014500 / 100 = $17.21

Click to enhance image

Click to enhance image